In late February, I had a poll on my page about Social Security, asking at what age you began, or plan to begin, taking your benefit. Where do you think you fit in the spectrum of answers? Read more and find out.

But before you read any further – I am NOT an expert on Social Security. Please don’t take anything in here as advice. You should always consult with an expert when making this important decision.

Social Security statistics

Before checking the poll results, let’s start with a few statistics to learn what most people across the country are doing.

Starting at age 62

Did you know the most popular age for starting Social Security is 62? I was a little surprised by that, given the cut in benefits that entails.

Taking the benefit at 62 has been declining, however, since about the mid-1990s, according to the Center for Retirement Research at Boston College analysis of Social Security Administration data. Maybe because people are realizing they’re taking a huge cut?

48 percent of women and 42 percent of men signed up for Social Security at age 62 in 2013, down from around 60 percent of women and 55 percent of men in 2005.

If your full retirement age (FRA) is 66, you’ll get 25% less by taking social security at age 62. It’s 30% less if your FRA is 67. That’s quite a reduction.

I understand why some people choose to take it at 62. Even 25-30% less helps pay the bills and may be a necessity if you have no other sources of income.

You may also have a medical condition that could result in a shorter life. Knowing your breakeven age could help you make this decision. The breakeven age is the age at which total benefits received equal the same amount under different age elections.

The breakeven age typically ranges from age 77 to 81, depending on earnings and the ages used in the calculation. You should work with a financial planner or find a good calculator to help you determine your breakeven age.

Maybe you want the money earlier while you’re still young enough to enjoy doing things like traveling. Or, maybe you think social security won’t be around by the time you reach full retirement age or beyond?

Other ages

Ages 63 and 64 are unusual ages for starting benefits. Only about 8% of women and 7% of men take social security at either 63 or 64.

Full retirement age varies depending on when you were born. I was born in 1956, so my FRA is 66 and 4 months. I can’t even take benefits at 65 without taking a cut close to 7%. And it would be more for anyone born after 1956.

The Center for Retirement Research found just over a third of men (34 percent) and a quarter of women (27 percent) sign up for Social Security benefits at their full retirement age, which is the second most popular age to claim payments.

Only 4 percent of women and 2 percent of men hold out until age 70, according to the Center for Retirement Research. Baby boomers would get 32% more if they waited until age 70.

My poll results

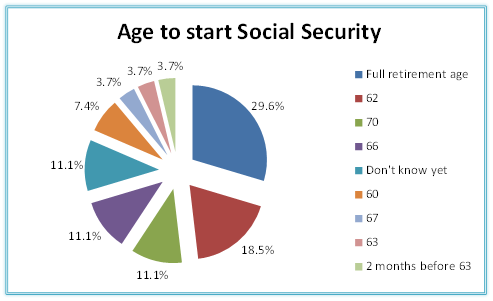

My poll results don’t quite match up with the statistics above. It could be due to my small sample size of 27. It could also be because of the type of people who read my blog. Regardless, here are the results.

As you can see, most people who voted in my poll have waited or are waiting until their full retirement age. This is a reverse of the national statistics, with age 62 coming in second in my poll.

Beyond that, the results are quite varied. I didn’t vote, but I’d be in the “don’t know yet” category. I did decide it wouldn’t be at 62. Our financial planner has worked out various scenarios for us, so what each of us does will be based on what’s best for us as a couple. It’s quite possible at least one of us will wait until age 70.

I’m not sure how two people in my poll could take their benefit at age 60. What am I missing here?

What’s the right answer?

As with many complicated decisions, it depends. That’s why no one can tell you what’s right for your situation. You can test scenarios and make educated guesses as to what will happen in your life, but in the end, only you can make the call.

If you’d like more information about Social Security retirement benefits, visit the Social Security Administration site.

My FRA is 66 and two months. I will wait at least until then to start collecting. My sister just turned 66, which is her FRA, and she is beside herself with joy. So funny what a milestone FRA turns out to be. Another good reference is Get What’s Yours: The Secrets to Maxing Out Your Social Security by Laurence Kotlikoff.

Thanks for the reference to additional information. I hope everyone checks it out!!